High ROE vs Low ROE! What is the concept of ROE ? Normal and Extended Du-Pont analysis

Extended

Du-Pont Analysis (The concept of ROE)

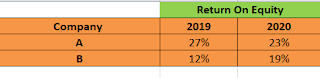

Two

companies having following ROE which will you buy? Other things are

constant.

Normal

DU-Pont Analysis

Extended Du-Pont Analysis

Now Let

us understand each parameter one by one.

a. Tax

Effect : It shows how much the tax a company is paying. If these figures are

heavily mismatching then there can be a huge possibility that they are making

manipulation in taxes to show profits more. Should not be fluctuated more.

b.

Financial Leverage Effect. It shows what the effect of leverage is having upon

the profitability of the company.Increasing is better as company is paying less debt

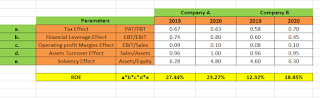

In the

figure above if we see Company B already has a high leverage effect i.e 0.40

(1-0.60) and 0.55 (1-0.45) is the year 2019 and 2020 respectively as compared

to Company A which has low leverage effect i.e 0.24 and 0.20 respectively.

Which is pretty good for profitability.

c.

Operating Profit Margin Effect: It shows what the profits a company is

earning without any kind of leverage.Increasing is better as company's operations are good without leverage.

In the

figure above we can see both the companies are having almost the same

proportion of profits if they do not use leverage.

d. Asset

Turnover Effect: It shows how much the sales a company is generating with the

help of total assets. Increasing is better. As company is efficiently using the assets to generate the sale.

In

the figure above if we see Company B generating the same asset turnover ratio

i.e 0.96 and 0.95 for the year 2019 and 2020 respectively as compared to

Company A which is generating 0.96 for the year 2019 and 1.00 for the year

2020. Which is showing that company A is efficiently using its assets.

e.

Solvency Effect : This is most important and should not be looked at as a

standalone basis. But should be combined with all the above 4 parameters.

Let us

understand how?

The ratio

itself shows how debt can impact the solvency of a company. Debt works as an

amplifier for the returns of the company.

When

Higher is better ? It is a boom for those companies whose above mentioned all 4

parameters are good. Because it is a cheap source of finance.

Hence

many times we see in the stock market that a company has increased the debt and

share falls sharply and another company who has increased the debt its share

rises sharply that is the concept behind debt.

Investor

Choices.

Comments

Post a Comment

Please do not comment any spam links.