How to 'hedge' the portfolio with the help of Derivatives? Futures and Options

Hedge the portfolio with the help of 'Derivatives' (Futures).

I have invested in

the Stock Market but I am afraid that my portfolio might fall drastically and

it has high probability....

How can I protect myself from uncertain high probability loss ???

Here Comes into a

picture the word 'Hedging'. Now the question arises how can i hedge my

portfolio and the answer is 'Derivatives'. Yes my friend it is only

possible with the help of derivatives. There are four types of derivatives

Forward, Futures, Options and swaps. We will only discuss here about the

Futures.

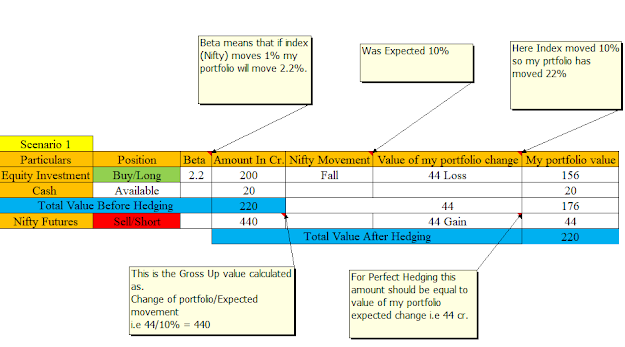

Now understand the concept of perfect hedging with the help of

FUTURES.

Let's take an

Example- You have a diversified equity investment 200 cr and available

balance in bank 20 cr. Beta of the portfolio - 2.2 (calculated as per specified

approach) Nifty CMP: 11010 NIFTY futures 11500 expected fall maximum 10%

from here. Now how many futures need to be sold for perfect hedging? 1 Index

future has 88 units.

To illustrate the example we have taken two scenarios. Scenario 1 (Where

you are right) and Scenario 2 (Where you are wrong) because both the

possibilities can happen. But if you see we lost our profit in scenario 2 where

the market rises. Hence it becomes the limitation of hedging so the purpose of

hedging is only to safeguard you of the volatile movement in the market.

In both the scenarios my portfolio was same 220 cr. Before and

after hedging so it is perfectly hedge.

Comments

Post a Comment

Please do not comment any spam links.