How to trade in volatile market? Options Trading (Straddle and Strangle)

Market Looks Like Volatile ? Manage your risk with proper strategies.

Want to trade in the volatile market with proper risk management? When we talk about risk management then suddenly it clicks with options strategies. And out of so many strategies available for options trading we will discuss here two popular strategies for options trading i.e Straddle and strangle

let us understand how these strategies work in a practical way.

Assumed, CMP of Index 2,700 for both the cases.

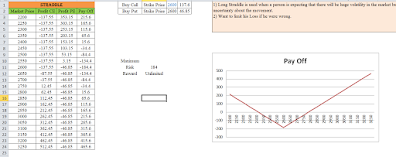

1) Straddle: To form the straddle strategy we need to buy a call and buy a put with the strike price near to CMP. Here trader expects that there is some big news or an event but not sure which side the market will move hence he prefers this strategy.

Eg: Annual Budget, Financial policy reforms, Government election results, Government policy reforms etc.

Formation:

Strike Price 2,600

Buy Call @137.6

Buy Put @ 46.85

With the same strike price which is nearby CMP.

See how your pay off will look like.

In this case your maximum loss will be the premium you paid to form the strategy i.e 184 (137.6 + 46.85) and maximum profit will be unlimited.

2. Strangle: To form the strangle strategy we need to buy a call with a high strike price ( Strike Price > Current Market Price) and to buy a put with the low strike price

( Strike Price < Current Market Price)

. Here trader expects that there is some big news or an event but not sure which side the market will move hence he prefers this strategy.

Eg: Annual Budget, Financial policy reform, Government election result, Government policy reforms etc.

Formation:

Lower Strike Price 2,800

Buy call@ 46.85

Higher Strike Price

Buy Put@41.35

See how your pay off will look like.

To understand how to select a good strike price please watch the video

Investor Choices

Comments

Post a Comment

Please do not comment any spam links.